This is part I in a three-part series highlighting key market trends in the North American nonwoven filter media market based on INDA’s recently published North American Nonwovens Industry Outlook. Part II in this series drills down on key trends in air filtration specifically, and that article can be found here. Part III focuses on key trends in liquid filtration.

Filtration has become so important that you can find it almost everywhere in your life. INDA, in its biennial North American Nonwovens Industry Outlook report, attempts to quantify the nonwoven filter media used in the many, many, many filtration processes.

The filtration market is an incredibly diverse one with seemingly endless categories. Filters allow us to cleanse the air we breathe and purify the water we drink. Filtration in the food and beverage industry removes impurities and extends the shelf life of the products we consume. Medical filters can safeguard sterile environments like operating rooms by keeping out harmful pathogens and bacteria. Filters in vehicles make them more efficient. These needs, along with government regulations and environmental concerns, have put the filtration market on a path of continued growth.

Nonwovens are well suited to the filtration market because the material can be specifically engineered to provide the precise porosity and flow rate needed for the particular filtering application. Nonwoven media are different sizes and shapes; may be perforated, folded, pleated, or fluted; and may be used in pleated tubes for tube filters and in cartridge filters. Filter media are manufactured from nonwovens produced from all of the processes: drylaid (carded and airformed), spunlaid, wetlaid, and airlaid short fiber, from a variety of materials. The meltblown technology is important to the filtration market, as meltblown material significantly improves a filter’s efficiency and holding capabilities. Because of versatility with these properties, the filtration market is one of the largest end markets for the meltblown technology.

In addition to filtering, nonwovens can be engineered to offer benefits for many applications, including the removal of a wide range of contaminants, a uniform structure, tear and puncture resistance, chemical resistance, high retention capacities, high air permeability, excellent abrasion resistance, flame retardancy, the absorption of fats and oils, a high level of flow capacity, and high tensile strength.

The nonwoven filtration markets customer base is the most diversified of all the nonwoven end-use categories, with more than 30 major market segments with nonwoven filter needs that vary in size from four story filter houses with up to 1,800 filters down to blood filters.

The sales to end users of filtration products in North America were estimated at $21.0 billion in 2019, a 5.0% annual increase from 2014. The filtration market is forecast to rise to $26.9 billion by 2024 a 5.1% annual growth rate.

Economic and population growth will increase demand, which will require increased production and increases in manufacturing efficiency for industrial products, foods and beverages, and transportation. All of which means an increased need for filtration media.

The filter markets can be distilled into three categories: consumer, industrial/manufacturing/commercial, and transportation. Using those categories, industrial/manufacturing/commercial is the largest category consuming 38.0% of the area and 46.2% of the tonnage in 2019. In square meters the three categories were relatively similar in size in 2019 with industrial/manufacturing/commercial accounting for 38.0%, consumer 35.0% and transportation 25.2%. In tonnes, industrial/manufacturing/commercial is the dominate user, accounting for 46.2% of the tonnes in 2019, followed by transportation at 31.8% and consumer at 20.6%.

There are numerous drivers affecting nonwoven filter media demand, though the over-arching megatrends would be the demands for purer air and cleaner water, which are both the subjects of ever-more stringent legislation.

Economic and population growth will increase demand, which will require increased production and increases in manufacturing efficiency for industrial products, foods and beverages, and transportation. All of which means an increased need for filtration media. As the housing recovery strengthens, and consumer spending activity continues to improve, so will consumer spending on water and air treatment systems. Rising home sales will also drive sales, since many consumers purchase or upgrade water and air treatment systems once they move into a new home. As the economy strengthens, consumers should return to replacing their existing filter products closer to the recommended replacement periods. Continued trends toward the incorporation of “smart” features and complementary monitoring devices indicating filter replacement time and toward specialized, industry-specific filtration media will support unit growth.

The further strength of the manufacturing and industrial sectors, specifically the power generation and hydrocarbon processing segments, will boost filtration demand as well. As manufacturers look to streamline their manufacturing processes, filtration of resources is increasingly being viewed as a way to boost efficiency and reduce carbon footprints.

Much of the filtration market demand is based upon replacement; that is, filters are exchanged after a useful service life. This feature is a factor across the consumer, commercial, and industrial filtration markets, though it is in the consumer end uses that, given tighter economic times, consumers may have used filtration products past their useful life in order to save money.

Nonwoven filter media is used for the filtration of engine air, cabin air, oil, and fuel. The increasing demand for vehicles is projected to continue through the forecast period, which in turn, will create the requirement for nonwoven filter media. A better economic situation and shift in lifestyle along with the rising consumer confidence have resulted in the increasing demand for new, fuel-efficient and technologically advanced cars.

A significant boost to the air filtration markets will be the coronavirus-related mitigation efforts. Consumer and workplace health and safety is creating new filtration needs and is raising the bar on performance. The assumption is that the filtration industry will be able to deliver the needed filters and masks. The air pollution prevention benefits of masks, HVAC filters, and dust collectors are also greater due to the steady increase in wildfires. Concerns that media manufacturers have about building capacity, which will go unused after a vaccine is perfected, is somewhat unwarranted. Not only are there nonmask uses, but air pollution, indoor pollution, wildfires, and new viruses will boost mask demand.

Consumers are increasingly aware of the potential health and aesthetic benefits of water and air treatment systems and are becoming more willing to invest in these products to improve the environment inside their homes. Media reports about water and air contamination affect consumer perception about local water or air quality and thereby drive sales.

Another driver of the industry is new legislation and regulatory controls increasing at local, state and national levels. Enforcement of these regulations by the EPA and other agencies has increased the demand for products that limit emissions and has increased demand for products that protect people from the effect of emissions. Relatively comprehensive environmental regulations in the U.S. and Canada continue to drive filter use designed to promote air and water quality.

The market for nonwovens in filtration media is also growing—due to nonwoven media being more economical and better performing—by taking share from woven and paper-based filter media.

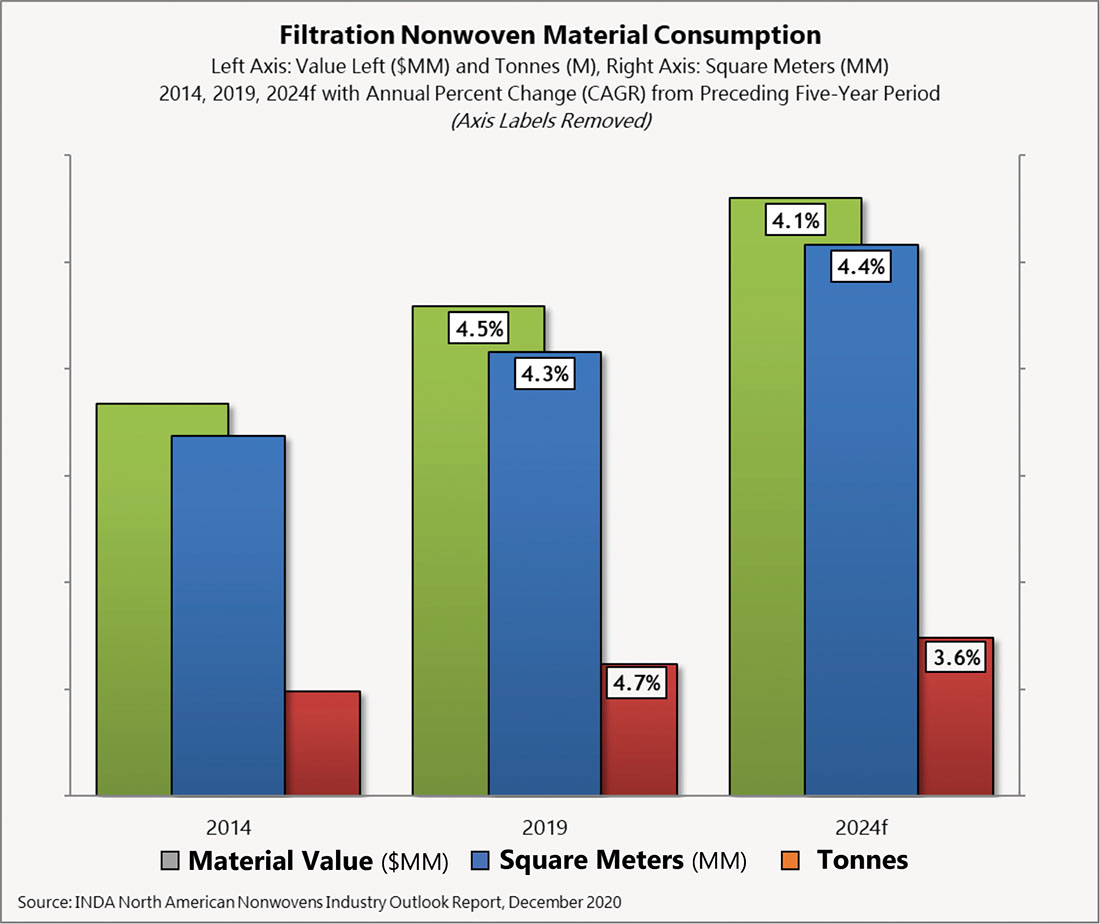

These drivers and developments have resulted in the North American filtration market consuming an ever-greater amount of nonwoven material—4.2 billion square meters, weighing 620,000 tonnes, in 2019. This is an increase of 4.3% annually in square meters and 4.7% in tonnes from 2019. INDA’s North American Nonwovens Industry Outlook, 2019-2024 forecasts the nonwoven filtration market to increase 4.4% annually in area and 3.6% annually in volume through the forecast period (2020–2024).

The North American Nonwovens Supply report is one of three INDA member-publications produced by INDA’s Market Intelligence and Economic Insights Group. For additional information on these publications and other INDA member benefits, please visit www.inda.org/indamembers/index.html.

International Filtration News is owned by INDA, Association of the Nonwoven Fabrics Industry (inda.org).

![Figure 1: Heat Exchanger Proventics GMBH.[22]](https://www.filtnews.com/wp-content/uploads/IFN_2_2024_crimpedmicrofiberyarns_Fig.-1-Heat-exchanger-225x125.jpg)