This is the second part of a three-part series in International Filtration News, providing a high-level view of the overall filtration market, drivers and size. You can find Part I of this series in Issue 4 of IFN or online at bit.ly/vastfiltermarket-partI. Here we take a deeper look at the air filtration market, with Part III to focus on the liquid filtration market. We will add a link to Part III as soon as it is available.

Cleaning and purification of air is required in living and workplace environments in hundreds of industries to control containments flowing into the atmosphere. Air filtration products include filters for vehicle air intake/induction, vehicle cabin air, commercial and residential heating and air-conditioning (HVAC) systems, cleanrooms, laboratory hoods, personal protection (such as facemasks and respirators), large baghouse filters, air intake for turbines, industrial dust collection systems, and vacuum cleaner bag filters. The most common fibers in air filtration include polypropylene (PP), polyester (PET), glass fibers, and cellulose.

Each area is seeing steady growth as end users become more aware of their ability to improve the air they breathe at work, in their cars, and in their homes, while the industrial/manufacturing segment improves as the economy improves and businesses look to boost efficiency and improve their processes.

A significant boost to the air filtration markets will be in coronavirus-related mitigation efforts. Consumer and workplace health and safety is creating new filtration needs and is raising the bar on performance. The assumption is that the filtration industry will be able to deliver the needed filters and masks.

The air pollution prevention benefits of masks, HVAC filters, and dust collectors are also greater due to the steady increase in wildfires. Concerns that media manufacturers have about building capacity, which will go unused after a vaccine is perfected, is somewhat unwarranted. Not only are there non-mask uses, but air pollution, indoor pollution, wildfires, and new viruses will boost mask demand.

Increases in filtration efficiency for commercial air systems and at residential locations will cause dollar sales to increase at a more rapid rate than units, given the higher cost per unit.

In terms of categories, INDA defines the air filtration categories as:

- Industrial/Manufacturing, primarily Dust Collection Systems, Turbine Air Intake, and Industrial Pollution Control

- Transportation, primarily Induction/Air Intake and Cabin Air

- Commercial Air Systems, segmented into High Efficiency (HEPA and ULPA, including Medical and Industrial Controlled Environments), Mid-Range Efficiency (MERV 9-15), and Low Efficiency (MERV 1-8)

- Residential Locations, primarily HVAC/Furnace and HEPA/ULPA Air Purifiers

- Personal Protection/Facemasks, primarily Respirators (including cartridges) and Facemasks

- Vacuum Cleaner Bags, segmented by Standard, Standard w/Meltblown Liner, HEPA w/Meltblown Liner

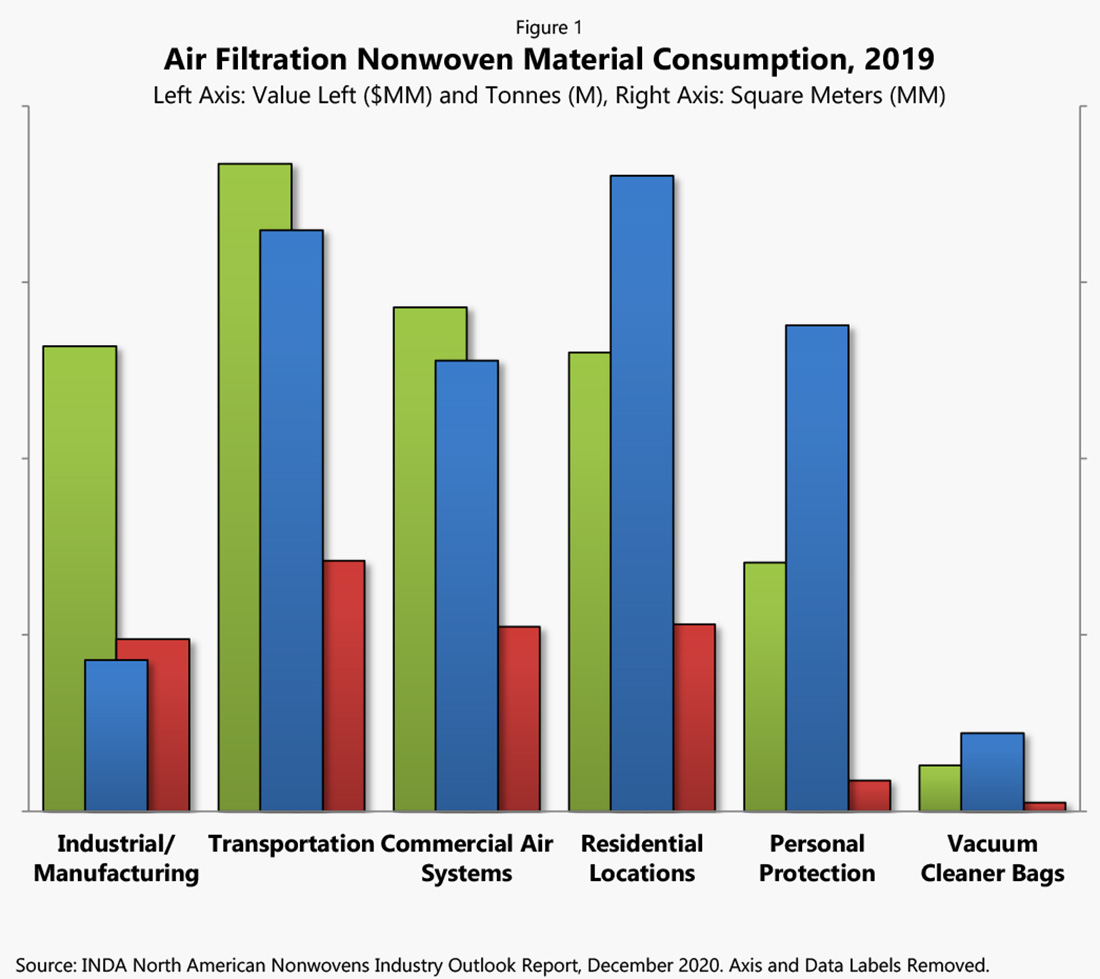

The largest category depends upon how you view it, that is the unit of measurement. The transportation category is the largest in value of the air filtration market, accounting for nearly a third of the dollar sales to end users (31.8%); while personal protection, due to the small size of facemasks and respirators, accounts for the majority of individual units (70.6%) (Figure 1).

In terms of North American nonwovens area consumption for air filtration end uses, residential locations was the largest square meter category, accounting for a quarter (26.7%), followed closely by transportation (24.4%) (Figure 1).

Below is the North American growth outlook (2020–2024) for each of the categories, in a simplified format, followed by a brief summary for each.

++ Industrial/Manufacturing

++ Transportation

+++ Commercial Air Systems

+++ Residential Locations

++++ Personal Protection/Face Masks

+ Vacuum Cleaner Bags

Industrial air filtration experienced strong demand from 2014 to 2019 as regulations on pollution and toxic gas emissions drove the purchases of pollution control equipment, including nonwoven filter media. Government regulations aimed at reducing particle emissions from various industries will continue to fuel market demand. Advances in technology and development of new media and design of filters are expected to drive market demand.

The growth of the transportation air filter market can be directly linked to the growth of the automotive industry (passenger cars, light commercial vehicles, heavy trucks, and buses/coaches). The demand model takes into account the production of new vehicles and the number of vehicles in use by year in the United States, Mexico, and Canada. The model accounts for the growing usage of air filters through time in vehicles, specifically the increased penetration rate of cabin air filters, which increased significantly between 2014 and 2019. The model also takes into account other transportation modes that use air filtration including off-road vehicles used in mining, agriculture, and construction; motorcycles; recreational vehicles; ships/boats; aircraft; and trains/rail locomotives.

Two trends will drive an increase in filtration efficiency in commercial air systems. The first being a response to the pandemic with ASHRAE’s (American Society of Heating, Refrigerating and Air-Conditioning Engineers) Pandemic Response Team recommendations and the CDC (Centers for Disease Control and Prevention) Guidelines. ASHRAE recommends that mechanical filter efficiency to be at least MERV-13, preferably MERV-14, or better to help mitigate the transmission of infectious aerosols. The CDC recommends improving central air filtration to the MERV-13 or the highest compatible with the filter rack, and seal edges of the filter to limit bypass. This increased demand is not only from traditional commercial locations, but also federal, state, and local governments increasing not only office spaces, but also education facilities. The second being, the California Air Resource Board which worked successfully with the California Energy Commission to increase the filter efficiency requirements in new buildings from the currently required MERV 6 to MERV 13.

Of the major changes, all HVAC systems, whether a large air handler in an office building or a small fan coil in a hotel room, will require MERV 13 filters. Previously the requirement was MERV 8 filtration and that was in the California Green Building Code. MERV 13 filters are typically standard in commercial office buildings, so this change will have minimal impact for those building spaces. However, high-rise residential and hotel buildings typically use MERV 8 filtration, so this will be a major change for those spaces.

The growth of the residential locations is very much tied to the construction of new homes and personal consumption expenditures. The demand model takes into account the number of households through the time period and applies a percentage for those residences with disposable filters, the number of filters per household (to account for multi-family units), and the number of annual filter changes per household. Additionally, a growing concern about indoor air quality is driving end users to become better educated about the quality of indoor air and the repercussions of poor air quality. Concerns about viruses, bacteria, and asthma are some of the main anxieties driving end users to become better informed. With people’s desire for better indoor air quality, the residential filter market is experiencing a growing demand for higher-efficiency filters.

Personal protection facemask categories include those sold at the consumer level and those used in industrial, commercial and healthcare environments. The threat of infections and pandemics will continue to be a strong driver through the demand period.

A development that had occurred in the vacuum cleaner bag category was the trend toward vacuum cleaners without bags. A growing percentage of upright vacuums and canisters are bagless, collecting dirt in a removable container and a reusable filter. This phenomenon seems to have reached its equilibrium. However, in vacuum cleaner applications—bag and bagless—the bag or canister still leaks some dust and allergens that may affect the filter motor and/or leak to the local environment. The motor often requires protection filters. Leakage to the environment may be bothersome to people with allergy problems. As a result, many vacuum cleaners are equipped with post-filters, often a HEPA filter incorporating meltblown to capture residual traces of dust leaking.

The air filtration market is indeed a diverse one with seemingly endless categories and growth. These drivers and developments have resulted in the North American air filtration market consuming an ever-greater amount of nonwoven material, having expanded 4.5% annually in area and 4.9% in weight through the historical period (2014–2019). This growth will continue through the forecast period (2020–2024) as reported in INDA’s North American Nonwovens Industry Outlook, 2019-2024 report.

The North American Nonwovens Supply report is one of three INDA member-publications produced by INDA’s Market Intelligence and Economic Insights Group. For additional information on these publications and other INDA member benefits, please visit www.inda.org/indamembers/index.html.

*International Filtration News is owned by INDA, Association of the Nonwoven Fabrics Industry (inda.org).