The most profitable market for filter suppliers should be the lowest cost of ownership for the end user. The expenditure is determined by relevant facts. The quantities needed are determined by unique factors. There is a $1 trillion filtration and separation market with 100,000 niches of $10 million each.

Which niches will combine for the Most Profitable Market (MPM)? Each filter supplier will be best served by a unique combination of niches to pursue.

Each niche has its own combination of facts which need to be multiplied by the most relevant factors to provide the Serviceable Obtainable Market (SOM).

The achievable market share is shaped by the value proposition which in turn needs to be validated.

Validation can be likened to a jury trial where magazines such as International Filtration News are the courtrooms. Within the powerful IFN archives, the suppliers can populate them to ensure that the body of evidence is sufficient to convince the jury in this “Court of Purchaser Opinion.”

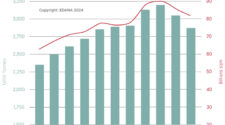

The aggregation of multiple MPM niches results in robust sales and EBITDA.

The foundation of business strategy can be the MPM niche forecasts. They set sales strategy down to the local sales level. The longer-range forecasts should be the basis for R&D, manufacturing investment, and acquisitions.

Most would agree that this is the ideal business strategy, but they would also question the practicality of pulling together the millions of necessary facts and factors.

By focusing on narrow niches, suppliers can better understand the processes and needs of the customers.

What makes it possible is that most of the facts and factors can be utilized in many different MPM niches.

Each $10 million MPM niche has a unique combination of facts and factors which should be separately and continually analyzed. MPM is based on a minimum of 20% market share. So, a 10-niche target would create a market of $100 million and $20 million in annual revenue.

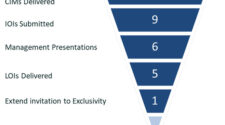

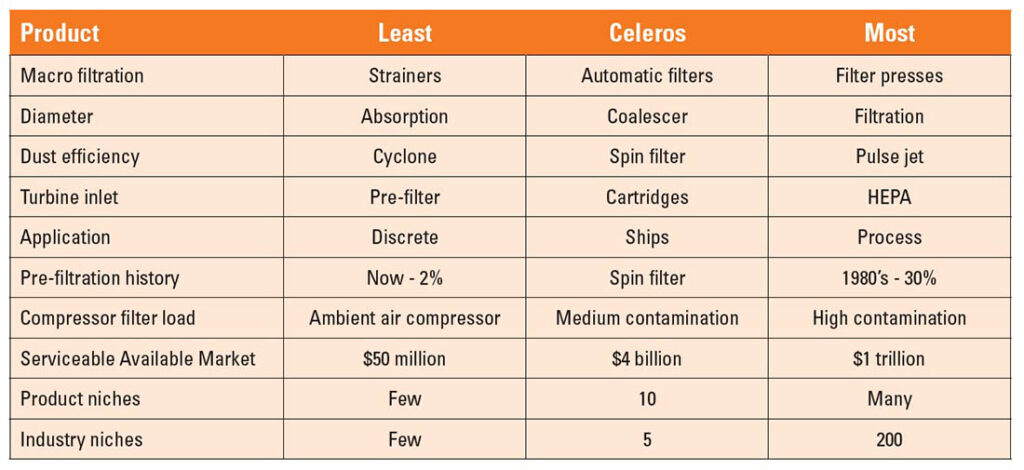

Celeros is a perfect example of a company with an MPM based on aggregating niches. Celeros is a $400 million spin off from SPX Flow. Pumps, valves and filters were included. The spinoff was based on the niche concept to separate products primarily used in certain industries.

Celeros products are used in the power and energy markets. The energy applications are further segmented into upstream, mid-stream and refining.

The Serviceable Available Market for the broader filtration segment, which includes the targeted niches, generates $4 billion/year in revenues. The MPM niches are less than $2 billion. There is a unique focus on niches in between the least and most. Celeros is pursuing the “Goldilocks” portion of the market.

The applications covered are upstream, mid-stream, refining, power, general industry and naval. In each case, the company is targeting specific markets but not the largest ones. Celeros makes pulse jet filter elements, but they are targeted for gas turbine intakes and not the very large coal-fired boiler dust collector applications.

This is in keeping with the “Goldilocks” principle since the filters are tasked with higher performance than needed for HVAC, but less than needed for capturing fly ash in high temperature, abrasive, and corrosive conditions.

There are ten products including air coalescers, liquid coalescers, cartridge filters, automatic filters, spin filters, intake filters, compressor filters, activated carbon, particulate filters, and mist eliminators. Each of the products is unique.

In general, they follow the “Goldilocks” principle of serving a relatively small market in between least and most. For example, strainers are the least efficient and filter presses the most efficient. The Celeros Automatic filter is designed to fill that 25- to 150-micron void.

Celeros Targeted Market

The most profitable niches often involve shared applications. For gas turbines, Celeros supplies the gas turbine intake filters but also valves. Celeros has a high market share in gas turbine bypass valves. In combined cycle plants, Celeros offers feedwater and lubricating pumps.

When a gas turbine shut down is scheduled there is the opportunity to replace the filters and repair the pumps and valves.

In terms of factors, the frequency of operation impacts filters, pumps and valves. The market is directly proportional to the quantity of gas turbines in use. This factor is shaped by other factors such as wind and solar with energy storage.

The entire industry will benefit from the MPM approach. By focusing on narrow niches, suppliers can better understand the processes and needs of the customers. Higher levels of profitability can be achieved when the cost reduction exceeds the higher prices. It will all be made possible by skillful litigation in the “Court of Purchaser Opinion.”