Discussions in determining the right business strategy usually center around your competition. The correct exit strategy when selling your business depends heavily upon creating competition among the bidders.

A competitive sell-side process is an art-form that your investment bankers champion when you decide it is time to sell your business. Too many times, a business owner thinks that going down a path with only one interested party will lead to a great outcome in valuation and meeting the personal goals of the selling family or shareholder. That assumption generally is not correct.

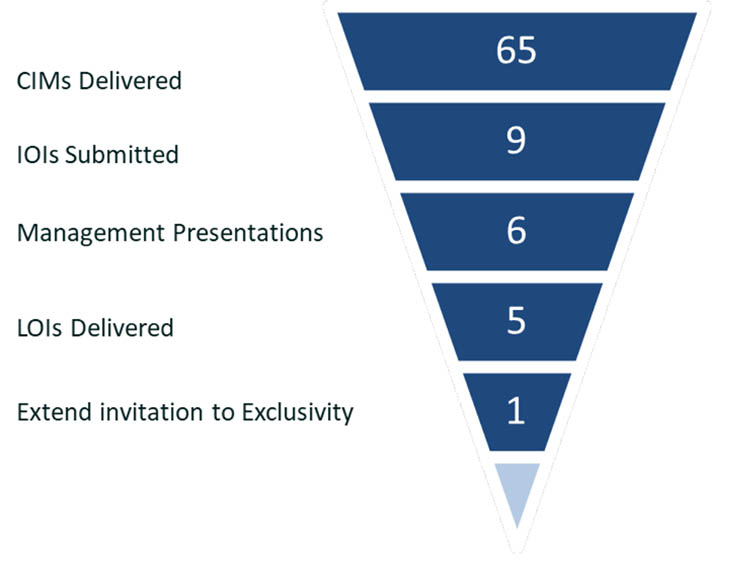

During M&A competition, generating broad interest is the goal and comes down to how many Confidential Information Memorandums (CIMs) are distributed to the prospective buyers that have executed an NDA. In the example below, the sell-side process resulted in nine prospective bidders submitting an Indication of Interest (IOI) with a valuation range based upon the information contained in the CIM. The bidder competition is now defined.

The next phase of the competitive process is called the Management Presentation (MP) round. Not every bidder submitting an IOI is invited to meet with the seller and their management team. Your investment banker interacts with the bidders and provides guidance on what is required, from a valuation standpoint, to be invited to the MP.

Achieving an “outlier” valuation bid occurs in the final phase, after the MP, when the finalist submits their Letter of Intent (LOI) in hopes of going exclusive with the seller. A fabulous result would be five of six finalists submitting competitive bids, allowing the seller multiple options for moving forward with a closing transaction.

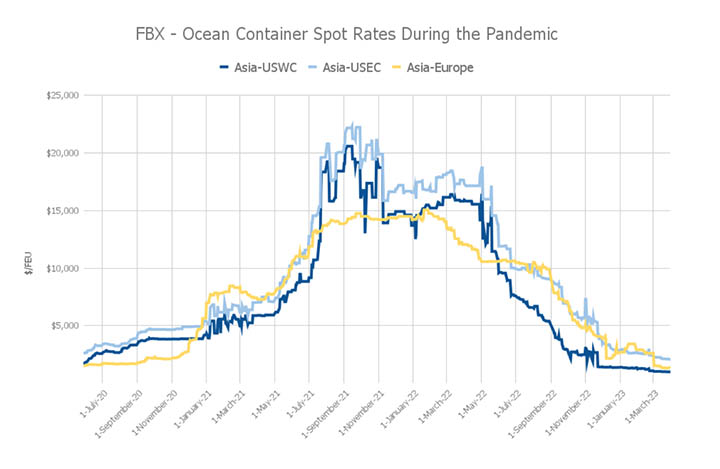

Business owners have done remarkably well during 2023. The M&A market continues to be bullish and certain sectors remain in strong focus for consolidation. Hopefully, the reduction in global transportation costs have benefitted your company.

This article has been prepared solely for informational purposes. This article does not constitute an offer, or the solicitation of an offer, to buy or sell any securities or other financial product, to participate in any transaction or to provide any investment banking or other services, and should not be deemed to be a commitment or undertaking of any kind on the part of Wiley Bros. –Aintree Capital, LLC (“WBAC”) or any of its affiliates to underwrite, place or purchase securities or to provide any debt or equity financing or to participate in any transaction, or a recommendation to buy or sell any securities, to make any investment or to participate in any transaction or trading strategy. Any views presented in this article are solely those of the author and do not necessarily represent those of WBAC. While the information contained in this commentary is believed to be reliable, no representation or warranty, whether expressed or implied, is made by WBAC, and no liability or responsibility is accepted by WBAC or its affiliates as to the accuracy of the article. Prior to making any investment or participating in any transaction, you should consult, to the extent necessary, your own independent legal, tax, accounting, and other professional advisors to ensure that any transaction or investment is suitable for you in the light of your financial capacity and objectives. This article has not been prepared with a view toward public disclosure under applicable securities laws or otherwise.