Ten thousand market niches averaging $10 million each comprise the filtration and separation market.1 The most successful filtration and separation companies are market leaders or have strategies to become the market leaders in the niches they pursue.

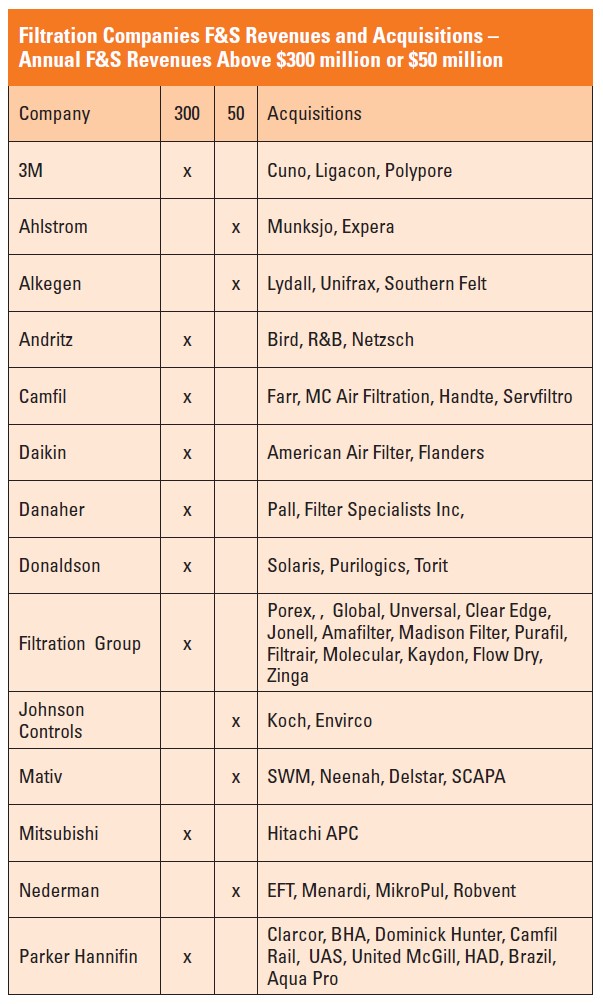

Much of this niche leadership comes from acquisitions. To obtain a good understanding of the market, it is desirable to review the acquisition history.

The McIlvaine Company was launched in 1974 to focus on filtration and separation market research and technology. The first exhibition attended was at the 1975 Filtration and Separation Expo in London. SCAPA was one of the major exhibitors with a range of filter media. The president of Amafilter was also chairman of the Filtration Society which was at the center of the world’s filtration activity.

Forty-seven years later the U.S.-based Filtration Group has purchased both Amafilter and the company who acquired the filtration divisions of SCAPA. MATIV, just formed from SWM and Neenah, has the non-filtration remnants of SCAPA.

The Filtration Group is one of the largest filter companies and certainly the only one which has achieved more than $1 billion in yearly revenues by acquiring large numbers of small companies.

Andritz has made a choice quite different from SCAPA. It has expanded its filtration activities to over $900 million. This supplements three process segments: pulp and paper, hydropower, and metals.

In these other three segments Andritz provides dryers, combustors and other process equipment along with pumps, valves and controls.

Its knowledge of the processes allows Andritz to supply “solutions” including remote O&M.

Alfa Laval, GEA, Mitsubishi, CECO, Danaher and Nederman are also examples of companies supplying process solutions.

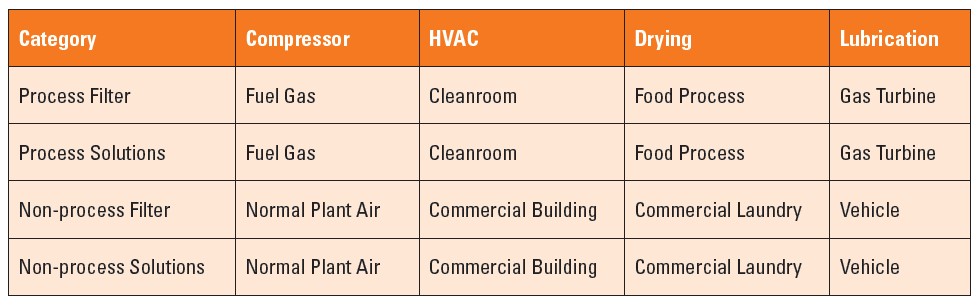

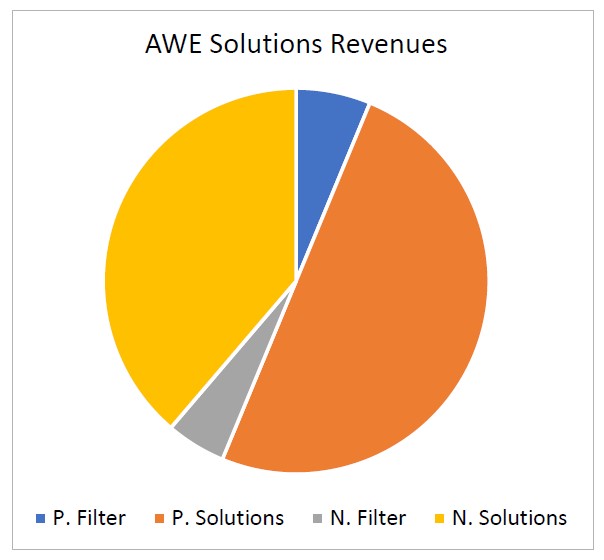

Much of the Parker Hannifin and Filtration Group business does not depend on process know-

ledge but on general product quality, delivery, ease of purchase and price. In fact, Parker Hannifin has one group who will supply and replace all the filters in a plant whether made by Parker or a competitor.

The market for the filters and solutions including all the process equipment, such as dryers and compressors is $750 billion per year.

The market is made up of 75,000 market niches averaging just $10 million in annual revenue. Companies such as Filtration Group and Andritz are market leaders in many niches. Most of the Andritz filter capability is a result of acquisitions. All the Filtration Group capability is a result of acquisitions.

In many respects Filtration Group resembles a proactive private equity firm.

A number of investors have been involved with Andritz over the years, but it has prospered as a publicly held integrated company leveraging the synergy of solutions. With its Metris Digital Solutions and increased service presence it is maximizing the solutions opportunity.

Johnson Controls is an example of a company using filtration along with HVAC for commercial buildings.

Daikin, one of the world’s largest suppliers of heating and cooling equipment entered the filtration business with the purchase of American Air Filter (AAF) and Flanders.

Over the years AAF made attempts to penetrate the process solutions market. It purchased a division of Allis Chalmers making taconite pellet plants and using that knowledge to offer coal gasification systems. This effort was not successful and AAF withdrew from the process market.

Parker Hannifin is the market leader in the non-process filtration category but is also involved with the process filtration with the Clarcor and BHA acquisitions.

In retrospect, most of the new technology has come from small companies who are later acquired by large companies. One exception is Mitsubishi who is the market leader in flue gas desulfurization systems. The air flow through the FGD system in a 1000 MW plant is 3 million cfm. It would require eight 400,000 CFM scrubbers. Whereas competitors would build a 1,000-10,000 cfm module in their research laboratories, Mitsubishi built a full-size 400,000 cfm module at a cost of millions of dollars.

Mitsubishi has been very successful but the FGD vendors in general lost huge amounts of money. The problem was that the market was regulation driven and could quickly fall from $15 billion/

year to just $3 billion.

So, one of the lessons is to pursue the markets which will have attractive and steady growth. Donaldson has entered the biopharmaceutical filter market. Its strength has been in off-road machinery air filters, and industrial dust collectors. But with two acquisitions it is positioning itself to pursue a dynamic market.

1Air, Water, Energy Markets published by The McIlvaine Company.

![Figure 1: Heat Exchanger Proventics GMBH.[22]](https://www.filtnews.com/wp-content/uploads/IFN_2_2024_crimpedmicrofiberyarns_Fig.-1-Heat-exchanger-225x125.jpg)