Industry experts in filtration science and technology will chair seven sessions for INDA’s inaugural FiltXPO conference and exhibition, Feb. 26-28, 2020, at Navy Pier in Chicago.

The overall FiltXPO program will be chaired by Behnam Pourdeyhimi, Ph.D., associate dean for Industry Research and Extension, William A. Klopman distinguished professor at North Carolina State University, and executive director of The Nonwovens Institute. Co-chairs are Paul Marold, president, Lydall Performance Materials, and Taylor Sulmonetti, Ph.D., associate, Exponent.

As we prepare for FiltXPO, International Filtration News reached out to some of the event’s session chairs and exhibitors to get a sense for the challenges and opportunities they are focused on heading into this important event in our industry. The following provides a summary of the responses we received.

What are the top 2-3 challenges impacting/influencing the filtration space today?

Noora Blasi, Marketing Communications Manager, Ahlstrom-Munksjö

The filtration market will continue to be influenced by the increased global demand for cleaner and contamination-free air and water. Regulatory compliance and increased focus on safety in workplaces are also impacting the filtration market. These trends encourage filtration technology companies to develop next-generation solutions.

Ben Blundell, Business Director Americas Cast Elastomers, Filtration, E&E and Subsea, Stockmeier Urethanes USA Inc.

1. Cost savings without comprising adhesion. Several cases of reducing the amounts of adhesive have been seen, resulting in lower quality and life of the filter. Stockmeier Urethanes is committed to reviewing the need of the application before introducing cost savings on the chemical adhesion. There is a fine line between cost and longevity.

2. The traditional way of thinking has reduced the possibilities of using technological advancements. Currently, in many filter applications, a plastic or metal is used alongside an adhesive. To adhere media, in many cases the adhesive could also become the frame/end cap.

Ruben G. Carbonell, Chief Technology Officer, National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL), Biopharma Filtration Session Chair

1. Strong drive to convert biopharmaceutical production into continuous, or semi-continuous, processes to increase productivity and reduce costs.

2. Desire to convert as much equipment as possible to single-use disposable devices (SUD) to eliminate cleaning-in-place and equipment validation costs.

3. Desire to decrease process footprint by increasing capacity, throughput, of separation devices.

Consolidation in conjunction with rapid growth and demand makes it difficult for the industry to meet customer needs. Workforce issues are another challenge, which also impacts supply and demand in the industry.

Michelle Czosek, Executive Director, National Air Filtration Association

Consolidation in conjunction with rapid growth and demand makes it difficult for the industry to meet customer needs. Workforce issues are another challenge, which also impacts supply and demand in the industry.

There’s also the difficulty of people not seeing the payback in having good indoor air quality. There’s a cost associated with having increased air quality, and people need to be educated on why the long-term benefits outweigh those costs. We have to find ways to better educate people on the negative impacts ultra-fine particles are having on human health.

Mehmet Caglar Gönüllü, Sales Manager, Hifyber

Filtration companies need to address certain challenges to establish relevance in the market. The challenges are mostly related to regulations, implementing to new standards, meeting the demand for predictable performance and cost reduction.

The filtration requirements are changing, and new standards are coming into play. At this point, it is necessary to test and show the value of filter media to gain success in the filtration market. The cost of such testing must be accounted for as part of the startup cost of entering the filtration space as a business. Also, the roll goods have a major cost impact on the businesses. The roll media manufacturing companies need to generate a range of filter media in various widths to meet customer requirements.

China/United States trade negotiations are impacting the industry’s ability to forecast capital investments and outages for upgrades for plant sites, impacting overall demand. Additionally, the current tariff structure is limiting options for producers who source some of their goods from China …

Brian Little, President, Bondex Inc.

1. Industrial filtration engineers are facing the challenge of meeting emissions regulations while their plant throughput is at record high levels. Users have constraints on baghouse upgrade options, while traditional filtration fabric technology offers limited options to help solve these challenges.

2. A greater proportion of the filtration industry workforce is reaching retirement eligibility each year, causing our industry to lose valuable expertise while the need for innovation in this space is at an all-time high.

3. China/United States trade negotiations are impacting the industry’s ability to forecast capital investments and outages for upgrades for plant sites, impacting overall demand. Additionally, the current tariff structure is limiting options for producers who source some of their goods from China, causing producers to consider and qualify new sources of materials, which are not affected by this policy.

Paul Marold, CEO, Lydall Performance Materials, Air Filtration Session Chair

1. Customer awareness of the benefits of good indoor air quality. Conversely, the health, cognizance and mortality penalties of poor indoor air quality.

2. The inability of air filter manufacturers to drive the value of improved air quality to humans versus protected process equipment. Today’s residential air filters cost essentially the same as they did a decade ago. Meanwhile, oil, lube, and process filter prices have increased at over GDP rates globally.

3. Communicating the need for emissions control and the impact filtration products can have on climate change.

Christine Murner, Sales Director, High Efficiency and Specialty Filtration, Hollingsworth & Vose

Hollingsworth & Vose’s motto is “Innovation for a Cleaner World” … As an industry we have enormous impact on greenhouse gas emissions, energy efficiency, process productivity, as well as general health and safety. These represent both challenges and opportunities for our industry.

Takashi Owada, General Manager, Teijin Frontier (USA.), Inc.

1. Low pressure loss, high flow and longer service life while helping to reducing the cost of operation.

2. Customized filtration media to fit individual customer requirements. There is no one size fits all.

Greg Rhoden, National Market Manager for Engineered Products, Phifer Inc.

As a metal wire mesh component supplier to the filtration industry, we see trade/tariff uncertainties as a pressing challenge, but only in the short term. Manufacturers in general are also impacted by a shortage of qualified labor to replace an aging workforce.

Lack of clarity for the consumer – the filter manufacturer states, for example, that the filter can capture dust, pollen, etc., but there is no mention of the actual quality factor.

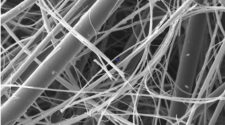

Alexander L. Yarin, Ph.D., Distinguished Professor, University of Chicago, Nano Fiber Filtration Session Chair

1. Lack of clarity for the consumer – the filter manufacturer states, for example, that the filter can capture dust, pollen, etc., but there is no mention of the actual quality factor.

2. The air filtration market is one where essentially the same filter for the same cost can deliver significantly different performance in terms of pressure drop. This is problematic. There are no guidelines on the pressure drop and quality factor – only filtration efficiency is considered.

3. Filters with adsorption capabilities, especially for heavy metal ions and pharmaceuticals, are insufficiently developed.

What are the top 2-3 opportunities you see for filtration today and as we look toward the future?

Alexander L. Yarin:

1. There is a need for ONE global testing protocol. This way, comparisons will be made easier.

2. There needs to be global standard for air quality. This is something that is hard to achieve, but can be a goal to work toward. Air pollution in one region can impact another region in the world.

Greg Rhoden:

2. Growth in “Made in the U.S.A.” products, as the playing field for fair trade is equalized.

3. Growth in demand for filtration products across the board, as air and emissions standards become more stringent.

Technology innovations that increase productivity and reduce costs in both the manufacturing process and finished filtration product(s).

Christine Murner:

We continue to see demand for improved IAQ and energy savings (filter pressure drop). We have made constant innovations in a number of “best in class” products, such as NanoWave™ and TECHNOSTAT™.

Paul Marold:

Addressing numbers 1-3 from my prior response above … There is a need for global regulation and controls on IAQ for the benefit of human health, as well as emission control and filtration improvement globally for the benefit of society. The air in China ultimately becomes the air in Europe and the air in North America. By having controls and regulations in place globally, we can alter the trend of air pollution. But … we as a GLOBAL society have to make this a priority and pay for it.

Brian Little:

1. As we look to the future of industrial filtration fabric technology, we see the trends continuing to accept higher performance fabric. This fabric is more efficient, lighter and more robust than the traditional felts used today.

2. We anticipate a shift to increased adoption of pleated elements in the future as a way to combat throughput and filtration efficiency challenges.

3. There are new felt technologies available today that provide users high-efficiency fabrics without the limitations associated with the use of ePTFE membrane laminated felt.

Mehmet Caglar Gönüllü:

There is potential for growth in healthcare, digital technology and zero emissions. Also, the high demand potential, rapid industrialization, increasing per capita income in China and India makes the filtration market very attractive, and China is expected to be a worldwide hub for a lot of filtration materials. Additionally, rising demand for high-performance and eco-friendly products is a key factor expected to drive the market in the future.

Up until now, the HVAC market has been dominated by micro-glass media and charged meltblown, which in the E12/H13 efficiencies (per the EN1822 test standard) is high priced. However, once the charges of the media are dissipated by loading, the efficiency of the material can degrade quickly. At this point, nanofiber synthetic materials are representing an opportunity with its low differential pressure and high filtration performance. The continued trend towards fully synthetic filter media in this market is creating additional growth opportunities for nanofibers. Nanofiber technology is a unique solution to fill the gap between conventional filtration materials and membranes, delivering exceptional and consistent performance.

Trains, cabin air filters for trucks, buses and off-road vehicles are growing fast to meet the EU air quality standards, and these applications are currently at F9 grade (per the EN779:2012 test standard), but trending to H13 in the future. Companies that would offer innovative products to these applications will get a foothold.

The healthcare and biomedical industry is the largest contributor to the growing demand of nanofibers globally. Applications such as drug delivery, barrier textile, wound healing and tissue engineering represent opportunities for nanofibers on a wide scale.

Emerging markets are always an opportunity for growth and revenue. One of the biggest emerging markets right now is in the area of indoor grow facilities, such as cannabis, which will provide even more opportunity as more areas turn to legalization.

Michelle Czosek:

Emerging markets are always an opportunity for growth and revenue. One of the biggest emerging markets right now is in the area of indoor grow facilities, such as cannabis, which will provide even more opportunity as more areas turn to legalization. Hospitals and facilities, such as swine farms, which need HEPA cleanroom-type filtration are also areas for growth. As the U.S. air filtration market becomes more technical, and people better understand the health benefits of good indoor air quality in different environments, opportunities will increase.

Ruben G. Carbonell:

1. There is a need for high-capacity, low pressure-drop product capture membranes to replace chromatographic columns filled with resins.

2. New surface chemistries are being developed to facilitate capture of contaminants and non-antibody products such as fab fragments, bi-specific antibodies, antibody-drug conjugates.

3. High-capacity membranes are needed to separate and purify some of the new biopharmaceutical modalities (gene and cell therapy), for example, to separate empty from full capsids and viral vectors.

Ben Blundell:

1. Water purification/filtration. As the world population continues to grow, we face continued need for clean water in global regions where water is either scarce or polluted. We are also now discovering our legacy of microplastics, which is an opportunity for filtration technology.

2. Improvement of current filter products to make them recyclable, reusable, increased longevity and higher efficiency. The focus has been on cost when the goal should be to improve efficiency.

Noora Blasi:

The challenges I noted in the prior question will turn into opportunities for filter media manufacturers. Our filtration solutions are addressing these important needs and opportunities by providing higher performing products for both industrial and transportation markets.

FiltXPO is expected to attract more than 2,000 attendees and 200 exhibitors for three days of technical program content within the hottest topics in filtration and separation. Technical conference sessions will run in conjunction with a show floor exhibition, featuring the latest technology solutions across the full spectrum of filtration and separation applications and processes.

For more details and to register for FiltXPO, visit filtxpo.com.

*International Filtration News and FiltXPO are owned by INDA, Association of the Nonwoven Fabrics Industry.

![Figure 1: Heat Exchanger Proventics GMBH.[22]](https://www.filtnews.com/wp-content/uploads/IFN_2_2024_crimpedmicrofiberyarns_Fig.-1-Heat-exchanger-225x125.jpg)