The 8th Filtration & Separation Asia (FSA) and the 11th China International Filtration & Separation Exhibition (CIFSE) was held December 9-11, 2020, in Shanghai, with industry players joining to represent the filtration and separation industry as the world continues to struggle with the impacts of the coronavirus (COVID-19) pandemic.

Exhibitors & visitors

The FSA + CIFSE were held in the Shanghai New International Expo Centre (SNIEC). Organizers of the event included the China Filtration Society (CFS) of the China Technology Market Association (CTMA), CNTA Science & Technology Co. Ltd. (CNTA), and Informa Markets.

The COVID-19 pandemic seemed to do little to stop the exhibitors and visitors from showing their enthusiasm to one of the largest filtration and separation shows in Asia, with the numbers of exhibitors and visitors, as well as the exhibition areas, all hitting or remaining at historical highs. Over 200 exhibitors attended the event and the number of visitors was approximately 10,000, similar to the levels in the event’s previous edition held in 2018, according to the organizers; while the exhibition covered an area of 12,500 square meters, up from 11,000 square meters in 2018.

There were two notable differences between this edition of FSA + CIFSE and the last one in entering the exhibition hall: visitors or exhibitors were required to download a green health code from an app and show it to the security people, and all were encouraged to wear a facemask.

The exhibitors were from Mainland China, the U.S., Japan, Germany, Finland, and several other countries and areas. Most of the foreign companies attended the show through their China-based subsidiaries or branches because the pandemic made international travel difficult. The exhibitors included Rettenmaier, Hollingsworth & Vose, Ahlstrom-Munksjö, Berry Global, and Johns Manville. These exhibitors targeted mainly the Chinese market, as nearly 99% of the visitors this year were from Mainland China due to the impact of the pandemic. In the last edition of FSA + CIFSE, foreign visitors accounted for approximately 5%, according to event organizers. With hundreds of professional visitors from other countries and areas such as India, South Korea, Japan, Indonesia, Thailand, and Taiwan in 2018, the 2020 FSA + CIFSE saw only a few dozen participants from outside of China.

The unexpected pandemic significantly increased the production of medical filtration materials in 2020. According to the China National Textile and Apparel Council (CNTAC), in the first 10 months of 2020, China’s industrial value-added of technical textiles increased 58.6% from 2019, while the whole textile industry decreased 3.7%.

During the show, organizers also held the 2020 Filtration & Separation Technical Presentation (FSTP) in the same hall. Executives and experts from 12 companies from the U.S., Germany, Finland, and China spoke about the applications and advances of filtration and separation technologies in various industries.

Long-term efforts and short carnival

Most of the nonwoven exhibitors said they had increased sales in 2020. Although the price peak in early 2020 increased the profits for nonwoven and medical textile producers, professionals tended to deemphasize the importance of that short carnival. “Although we did make a bit more profits in the first few months in 2020, a company’s stable growth relies more on long-term efforts,” said Mr. Nan Sheng, a Chinese nonwoven wholesaler and facemask producer.

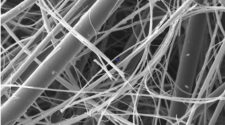

One of the regular exhibitors to this event, Berry Global has gained from the long-term efforts in the Chinese market. In our report on the last edition of this event in 2018, we noted that Berry Global said it would complete a production line for meltblown media to solely serve the Asian and Chinese market by 2019, which would mainly focus on air purification, industrial facemask, and automotive air conditioning filtration. With the automotive application facing some near-term market challenges, the other two applications were expected to offset automotive with a more promising near-term outlook. Berry’s investment in China proved wise.

In the first few months of 2020, Berry’s meltblown was in full operation as the meltblown retail price rose from 30,000 RMB ($4,400) per metric ton to nearly 700,000 RMB ($100,000) per metric ton. In June 2020, Berry was rated by the China Nonwoven & Industrial Textiles Association (CNITA) as one of the 30 best contributors in the textile industry who helped defend the COVID-19 pandemic in China.

Encouraged by the optimistic prospect in the Chinese market, Berry decided in October 2020 to add a new Reicofil R5 line in Nanhai, China, which will start to produce nonwovens used for surgical gowns and drapes and other medical products by September 2022. Berry hopes this new investment will further strengthen the company’s leading position in providing medical material solutions, according to Curt Begle, president of the company’s Health, Hygiene and Specialties Division.

COVID-19 leads the discussion

The FSTP speeches attracted a large number of attendees from various industries, such as air quality control, automobile, shipbuilding and petrochemical. The semi-open speech room, which could only contain a maximum of 60-70 people, was full throughout the conference program, and often more audience stood outside the speech room and listened with earnest attention. Many young engineers and entrepreneurs were clearly eager to explore new possibilities in the filtration and separation industry.

COVID-19-related topics were still the main focus among the 12 speeches. For example, Michael Wolf and Linus Wang from Palas Instruments and Zhiqiang Deng from TSI shared their technologies and methods for filtration efficiency testing for facemasks; Ethan Xiao, Frank Xie, and Will Luo from Hollingsworth & Vose discussed the indoor air quality control solutions for the post-COVID-19 pandemic period.

Other speeches focused on the digitalization and automation of the production of filtration and separation machinery and equipment, automotive fuel filter media, advanced filtration solutions, advanced materials for industrial filtration, petrochemical and others.

Big market shifts

Filtration and separation technologies often combine physical, chemical and biological methods and are widely used in many industries including water treatment, solid waste treatment, air purification, chemical, oil and gas, energy, metallurgy, automobile, food, electronics, air conditioning and HVAC. Although some of these sections had a very prosperous 2020, some others stagnated or even declined.

The unexpected pandemic significantly increased the production of medical filtration materials in 2020. According to the China National Textile and Apparel Council (CNTAC), in the first 10 months of 2020, China’s industrial value-added of technical textiles increased 58.6% from 2019, while the whole textile industry decreased 3.7%. China’s export of 200 billion pieces of facemasks and 2 billion units of the medical-protective garment (by early November 2020) contributed to a large share of this strong growth.

On the other hand, the automobile section remains one of the worst segments in the filtration and separation industry. According to China’s National Development and Reform Commission (NDRC), China will produce approximately 25 million units of automobiles in 2020, staying at a similar level as 2019. The stagnation will no doubt affect the auto-filter industry, which generates a market size ranging from $9 billion to $10 billion per year in China, according to several different market research companies.

![Figure 1: Heat Exchanger Proventics GMBH.[22]](https://www.filtnews.com/wp-content/uploads/IFN_2_2024_crimpedmicrofiberyarns_Fig.-1-Heat-exchanger-225x125.jpg)