Merger news rocked the specialty materials industry in July with the announcement that Mativ Holdings, Inc. formed after the successful completion of the merger of equals between Schweitzer-Mauduit International, Inc. (SWM) and Neenah, Inc. (Neenah), both leading global manufacturers of specialty materials. This merger created a mega-company boasting approximately $3 billion in sales, supporting customers in more than 100 countries, and manufacturing capabilities on four continents.

Mativ conducts business in two realms: Advanced Technical Materials (ATM) and Fiber-Based Solutions (FBS).

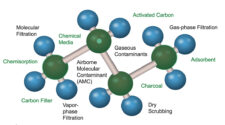

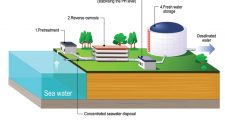

The ATM segment is comprised of Filtration, Protective Solutions, Release Liners, Healthcare, and Industrials. It will deliver solutions that filter and purify air and liquids, support adhesive and protective applications, advance healing and wellness, and solve some of material science’s most demanding performance needs.

The FBS segment is comprised of Engineered Papers and Packaging and Specialty Paper – and represents SWM and Neenah’s respective legacy paper segments. FBS will leverage the combined company’s extensive natural fiber capabilities to provide specialty solutions for various end-uses, including sustainable packaging, imaging and communications, home and office, and consumer goods, among other applications.

Julie Schertell is leading the charge as Mativ’s new President & Chief Executive Officer, yet she is no stranger to this industry. Schertell spent the last 15 years with Neenah rising in leadership, and the last three years as its President/CEO.

With the merger now complete, this global manufacturer brings a combined 30+ years of building and executing global strategies for companies within the commercial products and specialty materials industry.

International Filtration News sat down with Schertell to discuss business and the future. Conducting the interview for IFN is Dave Rousse, President Emeritus of INDA — Association of the Nonwoven Fabrics Industry. Dave joined INDA as President in late 2012 before transitioning to President Emeritus in June of this year. He has over 15 years’ experience in the nonwoven industry and built his entire career around engineered materials.

What I mean by “boldly reimagine” is that now is the time to really accelerate our growth and make bold decisions that may have been more challenging to make as two separate, smaller stand-alone companies.

Dave Rousse: I can imagine this is a very interesting time for you.

Julie Schertell: A very interesting time, a very busy time, but it’s also a very exciting time. You know, this merger is really about growth. And how we accelerate growth. How do we amplify growth across the two companies? I think that’s gotten everybody’s energy pretty high.

Rousse: That’s great. I recently read that you said this merger is a “unique opportunity to boldly reimagine our future as a stronger and faster growing global enterprise. As we come together, we see significant near and long-term value creation opportunities to accelerate growth and amplify the market.” Can you elaborate a little bit on what does the opportunity to ‘boldly reimagine’ look like to you?

Schertell: Sure! Let me first say that I think it’s important to recognize that both heritage companies have a lot of strength, and each company has a leadership position in different categories in which they compete. Both companies and its portfolios are very complementary. Filtration is an easy example: Neenah makes the filtration media, SWM makes membranes and spacers and netting. With those now combined, we create a stronger position for our customers. There was strength individually and now as we combine, it becomes a very powerful opportunity.

And what I mean by “boldly reimagine” is that now is the time to really accelerate our growth and make bold decisions that may have been more challenging to make as two separate, smaller stand-alone companies. Within that opportunity, I believe we have two to three years to really leverage the strength of this merger to create a larger leadership position in our space. So that means accelerating our pace of innovation, how we work together with complementary technologies to manufacture high-value, high-growth products using our collective material science expertise, and how we leverage the breadth of our combined capabilities, intellectual property and scientific know how. Now is the time to really press on the limits of what’s possible when we bring these two companies together.

Rousse: I do love the new name, Mativ, which causes me to think material innovation.

Schertell: Yes, you got it perfectly. It encapsulates building material solutions through innovation. We used an outside agency to help us come up with names. They did a great job that and we’re really pleased with where we landed, so I love it too.

Rousse: That fits very nicely with what we do at INDA. We see nonwovens as a growing industry, with boundless potential as these materials can be tailored to meet product design challenges and, as you know, there are always new product design challenges to be met. So, innovation is driving the way. What view does Mativ hold on this perspective, and its role in innovation?

Schertell: You know, solving critical challenges for our customers and nonwovens is a big part of our strategy, particularly in our filtration business, and our nonwovens technology platform now encompasses a multitude of capabilities. We have a wet laid process, dry laid, melt blown, thermal bond, nanofibers, polymer extrusion, netting, and component part manufacturing. We have the opportunity to utilize these technologies together in our manufacturing processes, as well as the fibers and polymers we use in production, to uniquely deliver characteristics to our customers such as fluid flow control, flame retardancy, advanced air permeability, and dust holding capacity. All of those are areas that we’re continuing to invest in and grow from a nonwoven standpoint.

We recently announced two large investments – one is a new melt blown line in Germany and the other is a silicone release coater in Mexico. I’m encouraged by our improved melt blown footprint in the U.S. as well as in Europe. As we think about innovation that’s core to what we do to be a successful specialty materials company and innovation has to continue to accelerate, and I think this combination unlocks that potential. It gives us more breadth of technologies and capabilities to build upon.

Rousse: This is music to my ears, wonderful! This is a combination of two great companies, with a great traditions and data. What can you tell us about how this combination came about, the synergies that we’re seeing and what you see as the key themes going forward?

Schertell: I would say that each company had the other company on their radar screen for many years. Our company headquarters are literally within about five miles of one another. As I got to know SWM CEO Dr. Jeff Kramer, he and I started having conversations about potential opportunities for the future. Then, both companies made a significant acquisition in the spring of 2021 that just further aligned our strategies and our capabilities so that the timing made a lot of sense for us to come together.

The merger itself really has three key components. First, as I mentioned, is unlocking growth for the future. That’s the primary one. The second one is the significant synergy potential. We’ve announced $65 million of cost-out synergies that will create significant value. And then the third one is scale – being a $3 billion company versus, two stand-alone smaller companies give us the opportunity to do things more efficiently from an administrative standpoint, as well as potentially make decisions that are more challenging to make as a small company, whether that’s about our portfolio, or how we manage innovation. There are different decisions and ways that we can do business with greater scale.

Rousse: What can you tell us about the new and combined team that you have been developing at Mativ and what are the key skill sets and areas of expertise being cultivated and what changes are happening?

Schertell: I am really, really thrilled with the team that we have in place and how well the teams are working together. It’s a great mixture of heritage knowledge from both former Neenah and former SWM, and my leadership team and the Business Unit leaders are a great mix of leaders from both former companies. I also like that it is a very global team. Six of our seven business unit leaders are from outside the U.S. So, I think we’re getting a nice diversity of perspective. As we become an even more global company, close to 60% of our revenue will be outside of the U.S. So strong talent for both teams, a lot of material science know how, coupled with engineering, is really at the core of what we do to create innovative materials solutions that are typically custom solutions to meet some of our customers’ most challenging needs. The breadth of portfolio that we have and technologies that I mentioned, particularly in nonwovens, helps us make solutions for our customers that are more challenging for others to make.

Rousse: All good stuff and exactly what we try to do with the non-woven sector. Julie, let me just finish by asking you is there anything else you would like to tell us what we can expect from Mativ?

Schertell: I think what you can expect from the company that is inventive and focused on growth. Innovation is going to be at the core of what we do, and it has been part of these two companies for many years. We also need to be both visionary and focused, meaning we have a broad portfolio and we will get very focused on where we have a bias towards growth, and filtration will clearly be one of those, nonwovens in general will clearly be one of those.

We will also be very practical. I’m a big believer that strategy is at the core of what we do, but it has to be actionable. It must be brought to life, and we have to measure what we’re doing. We have to remain agile as a company. We’re still a small company and so the speed in which we move, the agility that we have, the flexibility in our assets – that’s all at the core to how we win in the marketplace and with our customers and create products, and we’ll continue down those paths.

Rousse: Thank you for that. I did lament the fact that I’m losing one member when the two of you combined, but I do believe that this combination is terrific for you folks and great for the industry. And I want to thank you so much for your time.

Schertell: I’m very excited that and appreciate the opportunity to get to meet and chat for a little bit. Thank you.

Rousse: Thank you, Julie.