Air filtration media is used in treating ambient air as well as process-generated particulate. Filtration media companies, such as Lydall and Ahlstrom, provide media for both applications. There is some media common to both applications, but the process applications require cleaning of the media and can involve high temperatures, acid gases and other contaminants not found in ambient air. The purchasers of the media and the true cost of ownership analyses of each are different and warrant separate analyses. This article focuses on the ambient applications.

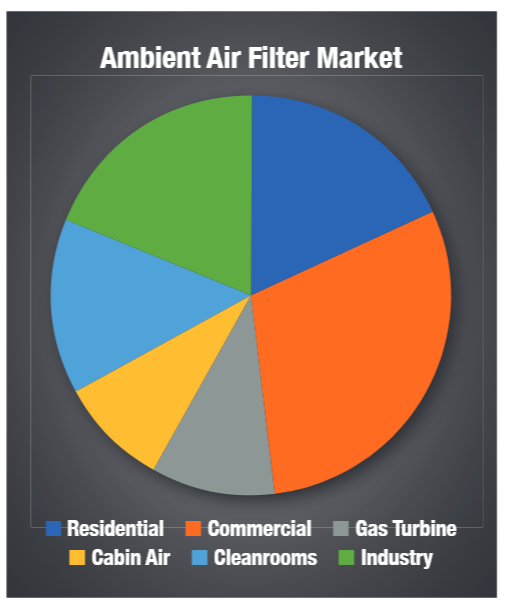

The world market for ambient air filters will exceed $9 billion by 2022.(1) Less than half the market will be for residential and commercial applications. The remaining industrial market includes:

- Paint booths

- Gas turbine intakes

- Cabin air in automobiles

- Cleanrooms

- Electronics

- Pharmaceutical

- Food, hospital, and other

The purchaser is interested in buying the media with the lowest total cost of ownership, but may buy based on lowest first cost or because there is a lack of knowledge on which supplier is offering the lowest true cost product. So one market share question is the percent of purchases based on lowest true cost.

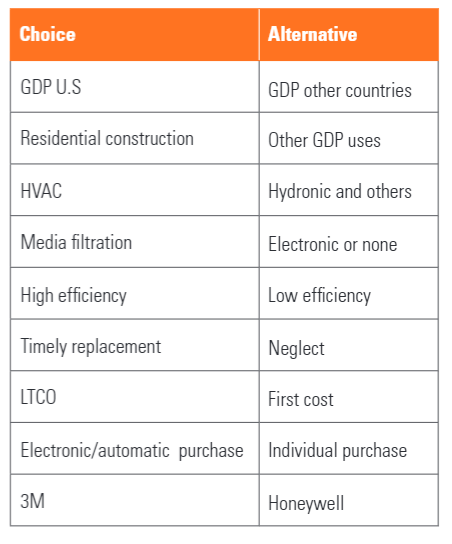

Most market research is a standalone periodic effort. A more reliable approach is a continuous “market share hierarchy analysis.” An example for residential filters would be:

In countries such as China and India, GDP growth is triple the world average, resulting in a fast growing middle class population. The present and future market share for people who could afford central air heating and cooling needs to be addressed in each country. The market share for central air vs hydronic and other heating and cooling methods also needs to be continually assessed.

The lowest total cost of ownership is impacted by the efficiency goals. The residential market has nearly doubled just because homeowners want the medium efficiency rather than low efficiency filter. A new variable is the bluetooth-enabled pressure sensor, which alerts the homeowner to the need to change filters with an option for the automatic delivery of a new filter when the filter pressure drop has reached a pre-determined level.

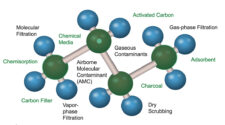

Gas phase filters are gaining market share to remove odors and gaseous contaminants. So determining the market share where particulate and gas phase are both utilized is important:

- Particulate

- Particulate and gas phase

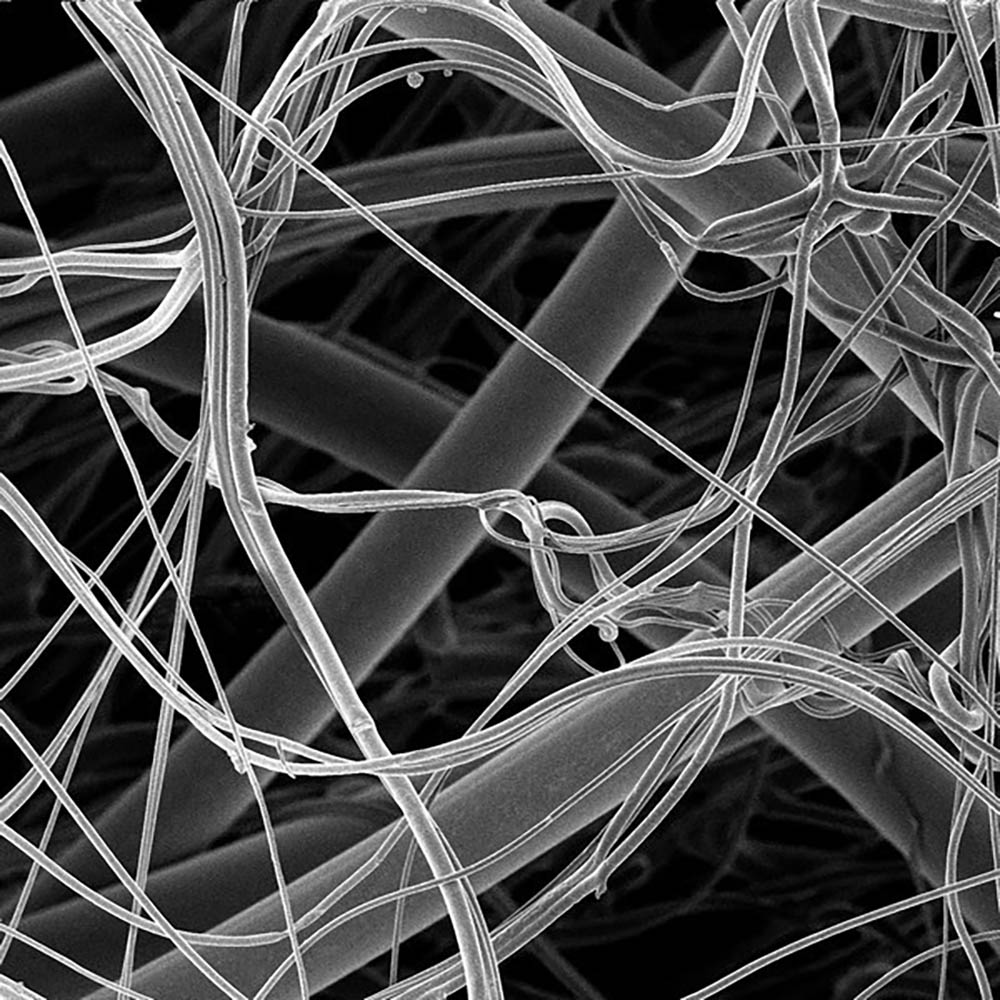

The filter design depends on the media selection. The media selection depends on the efficiency requirement. The TCO includes the purchase cost, labor to install, cost of disposal, energy cost, and life. There are differences depending on the media type:

- Spunbond

- Wet laid

- Needlefelt

- Meltblown

- Other

The life of the filter and the cost of replacement influence the choice of pocket filters for commercial applications as opposed to the pleated filters with less dust holding capacity or the panel filters with the least dust holding capacity:

- Panel

- Pleated

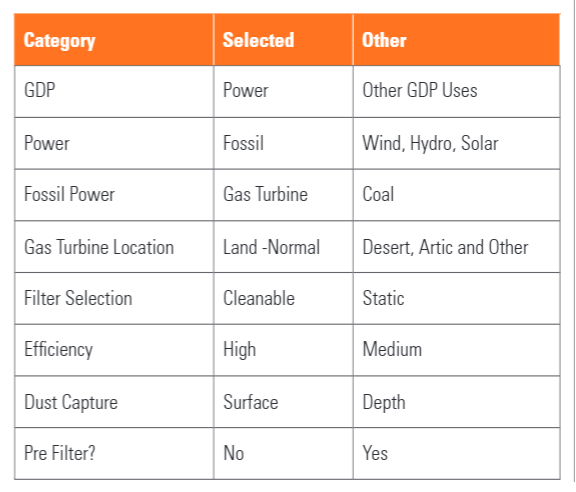

The challenge of creating a reliable market share hierarchy is illustrated with the gas turbine intake filter application. Filters are used to purify ambient air being introduced to the turbine combustion zone. To determine market shares for any or all suppliers and to predict the future market each of the hierarchy market shares is needed.

The total cost of ownership is generally the basis of decision making among gas turbine owners. Some studies have shown that a high efficiency HEPA grade filter can reduce turbine maintenance enough to justify a price up to four times the medium efficiency filter. However, this is a function of turbine location, hours of operation per year and type of turbine.

Filter and filter media suppliers can benefit from a continuing market share hierarchy analysis. This entails understanding of the broad trends starting with GDP by country and then specifics such as how many automobiles will be produced; how many will have cabin air purification units and how many will be painted in booths with filtered intake air. It is relevant to determine how many air changes per hour each of the casting, engine and assembly plants require.

The market share hierarchy can then be extended to competitors and customers. For the media supplier it is important to know competitor market shares by media type. It is important to know market shares for various OEM purchasers, market share for online stores, and purchases by major customers such as the power plant owners and automobile manufacturers. If these shares are continually updated, market research can become the foundation of the business strategy.

International Filtration News and Mcilvaine Co. are creating a system to provide assistance to air filtration decision makers. This article is an introduction to the program, which will include a continuously updated “Air Filtration True Cost Decision Guide” on filtnews.com. Stay tuned for more.

Learn more about McIlvaine’s “Air filtration and purification world market” report at http://bit.ly/airfiltrationreport.