The true cost of one filter as opposed to another has been traditionally limited to considerations of energy cost vs performance. Health has been a factor in filter decisions, but not dominant. In this pandemic era the concept of true cost includes health factors measured in $ billions and even $ trillions and is unlike any challenge or opportunity previously faced by the industry.

The evidence is now clear that coronavirus transmission is largely through small aerosols. Larger droplets captured in filters and masks evaporate releasing virus particles. As a result tight-fitting efficient masks and highly efficient filters rated at MERV 16 and higher are needed.

With sufficient investment in these two products, the COVID battle would be won. The value in avoided economic and social cost would be tens of trillions of dollars. We are used to talking ROI of years. Here we are talking ROI of minutes.

The high McIlvaine forecast has three billion people wearing masks costing from $50 to $500 per year, resulting in total yearly purchases of $675 billion.

Equally amazing is the size of the market. It is hundreds of billions of dollars per year when both masks and HVAC filters are included. In many cases, orders of magnitude increase in production will be needed.

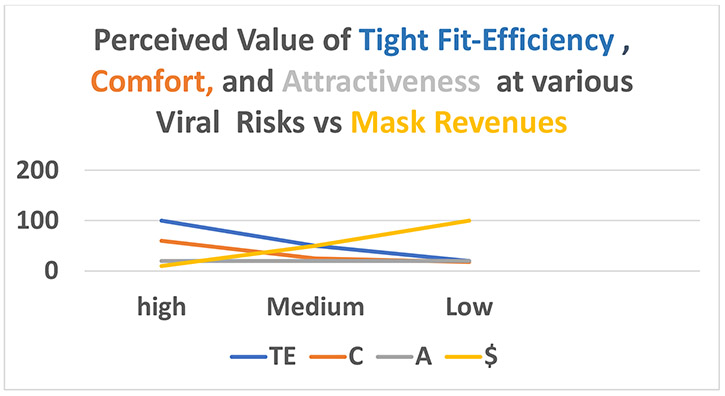

Another aspect which is new to the filtration industry is the advantage of adding “attractiveness” to the product benefits. In fact, McIlvaine is predicting a huge market in what could be called CATE masks. These are masks, which are Comfortable, Attractive, Tight fitting and Efficient.

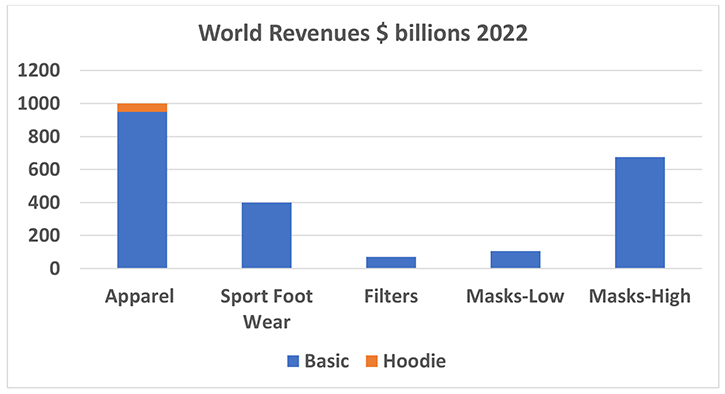

The CATE and other mask market will be larger than the sports footwear market. It will be 12 times larger than the market for hoodies and considerably larger than the rest of the filtration market. The combined mask and filter market could be as large as $750 billion/yr.

The high McIlvaine forecast has three billion people wearing masks costing from $50 to $500 per year, resulting in total yearly purchases of $675 billion.

World Mask Purchases in 2022

|

World Mask Purchases in 2022 |

|||||

|

Tier |

# of People |

$ Cost/yr per Person Low |

2022 Market $ million Low |

$ Cost/yr per Person High |

2022 Market $ Millions High |

|

Top |

500 |

100 |

50,000 |

500 |

250,000 |

|

Middle |

1000 |

40 |

40,000 |

200 |

200,000 |

|

Bottom |

1500 |

10 |

15,000 |

50 |

225,000 |

|

300,000 |

105,000 |

675,000 |

The 500 million people who will spend $500 per year will be wearing masks in low virus load situations where the attractiveness factor equals that for comfort and tight fit/efficiency.

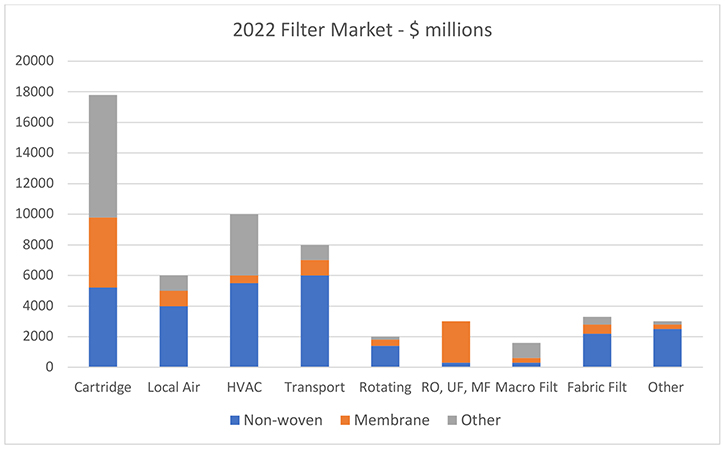

There will be large increases in filters for local air systems including air purifiers and fan filter units, which will replace partitions at checkout counters and on meat processing lines. The HVAC and Transportation filter markets will also increase substantially.

The filter forecasts are for complete filters. The filter media accounts for 20% to 60% of the total depending on the application. Nonwovens and membranes account for more than other filtration media in each of the categories. The same nonwovens and membranes used in masks can be used in these other filter applications. Meltblowns will not predominate in CATE masks. Membranes nanofibers and bicomponent spunbond will be selected because the masks can be reused many times.

This base forecast assumes:

- a proactive approach by the filtration industry

- understanding of the benefits of high-efficiency media

- the long range mask market will be robust because of air pollution and other concerns as well as the potential for new viruses to appear

- media suppliers will be supplying multiple markets and will not be hard hit by swings in the mask market

Unlike past forecasting of the filtration market there are very large differences between the base, high and low forecasts. This has been a situation with which the semiconductor industry has had to deal with for decades. The filtration industry therefore has a good example to follow as it prepares for any eventuality.

For more information on McIlvaine’s “Coronavirus Technology Solutions” report, see http://bit.ly/mcilvaine-coronavirus-database.

![Figure 1: Heat Exchanger Proventics GMBH.[22]](https://www.filtnews.com/wp-content/uploads/IFN_2_2024_crimpedmicrofiberyarns_Fig.-1-Heat-exchanger-225x125.jpg)